How to Request Your Tax Compliance Certificate on iTax

Want to get a KRA Tax Compliance Certificate (TCC)? This guide simplifies what may seem like a complex task, helping taxpayers efficiently navigate their request for a Tax Compliance Certificate on iTAX for compliance needs. Here’s how you can apply and download it.

1. What is a Tax Compliance Certificate?

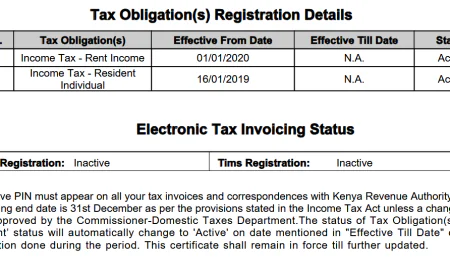

A Tax Compliance Certificate (TCC), also referred to as a Tax Clearance Certificate in Kenya, is an official document issued by the Kenya Revenue Authority (KRA).

It serves as evidence that an individual or a business has filed and paid all required taxes.

The certificate is valid for a period of twelve months.

2. Reason for Application or Information Needed for TCC Request.

When requesting a Tax Compliance Certificate (TCC), it's important to provide the reason for your application. Common reasons include;

- Applying for a job

- Submitting a bid for a government tender

- Renewing a work permit

- Operating as a clearing and forwarding agent

- Seeking a liquor license.

- Incase you need to confirm your compliance status or

- Meet other regulatory requirements.

3. Legal Requirements for Obtaining a Compliance Certificate

Taxpayers seeking a Tax Compliance Certificate must comply with the following to receive the certificate:

- Ensure that you clear all outstanding tax debts and penalties.

- File all tax returns on or before the due date for all applicable tax obligations.

- Pay taxes on or before the due date.

4. How to Apply for the Tax Compliance Certificate

The application for a TCC is done through the iTax platform, and the certificate is sent to the applicant's email address.

Here is the detailed procedure for applying online on the iTax Portal: How to Apply for the Tax Compliance Certificate on iTAX

5. Video Tutorial

For a complete visual procedure on how to apply for a tax compliance certificate, you can check out this video tutorial:

6. Useful Links

Was this information helpful ?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0