How to File Employment Income Tax Return for the Year 2024

Learn how to file your individual tax returns with ease. This guide simplifies the process for filing your employment income tax return. It walks you through the important steps for filing your Employment Income Tax Return in the iTax portal, ensuring you complete the task efficiently and accurately without complications.

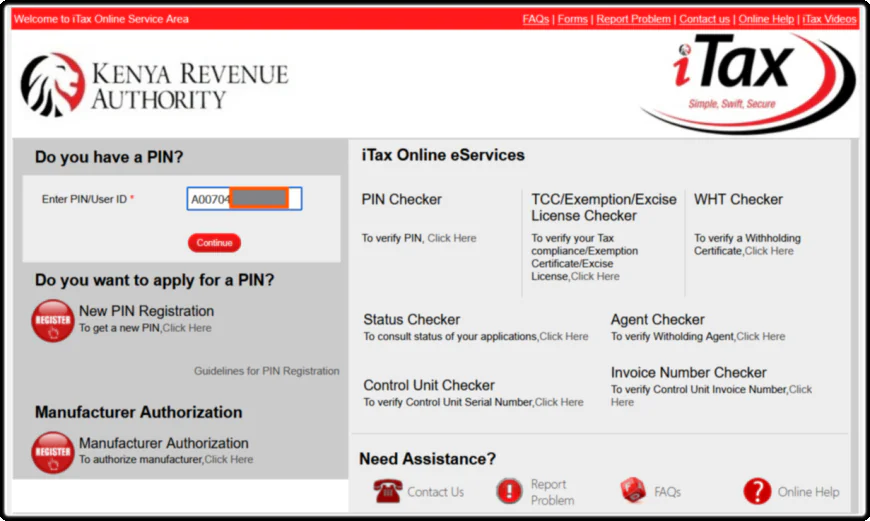

1. Visit the Official KRA iTax Portal

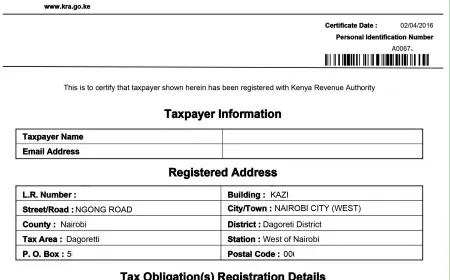

Visit the iTax Portal and enter your KRA PIN. Log into your account using your PIN and password.

2. Navigate to the Returns Tab Menu Section

Once logged in, navigate to the Returns tab menu and select "ITR for Employment Income Only."

3. Select Income Tax Return Menu (ITR for Employment Income Only)

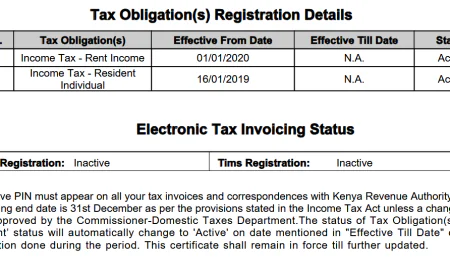

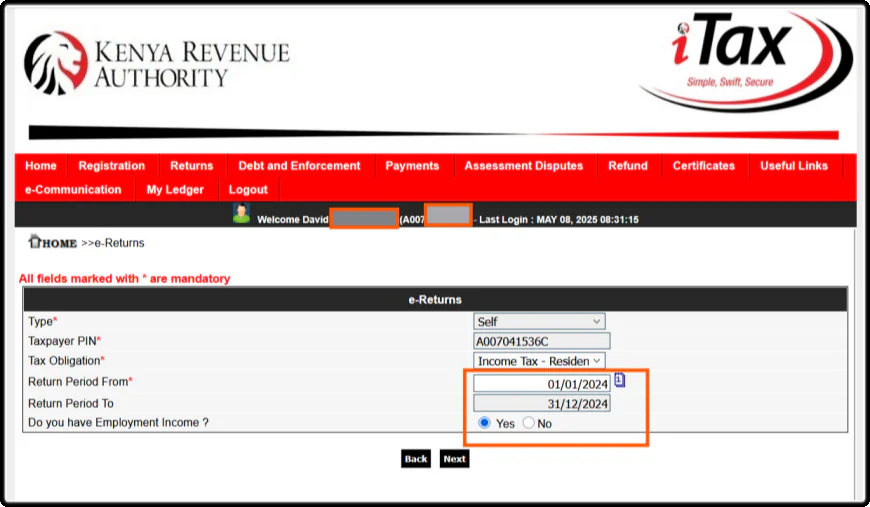

4. Confirm your Tax Obligations, Return Period, and Employment Status

You will find pre-populated details such as the taxpayer PIN and tax obligation on the return period form. Select the respective tax return year; for example, from 01/01/2024 to 31/12/2024.

If you have employment income, select "Yes" and proceed to the next page.

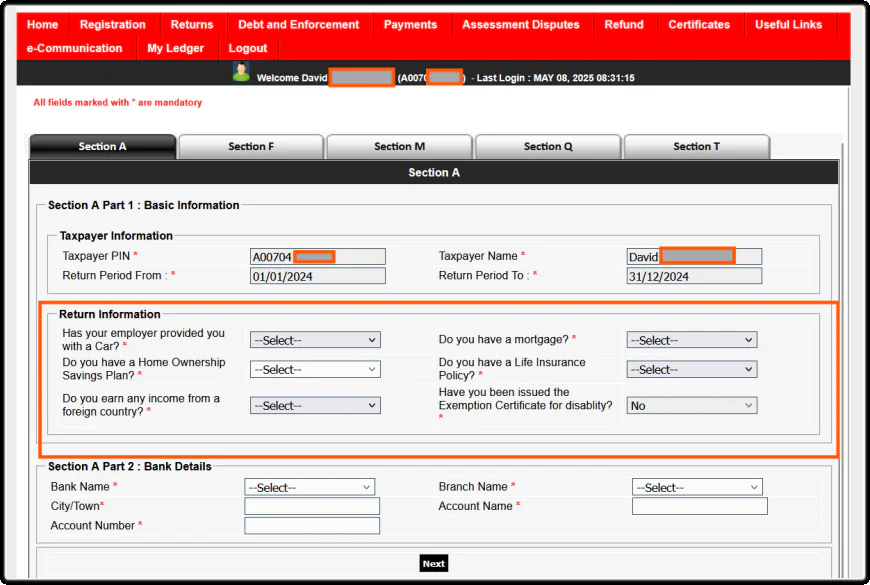

5. Section A: Return Information Section

This section requires you to fill in details marked with an asterisk. The sections include;

- Car Benefit

- Mortgage

- Home Ownership

- Life Insurance Policy

- Foreign Country Income Details, and

- Disability Exemption Certificate Details.

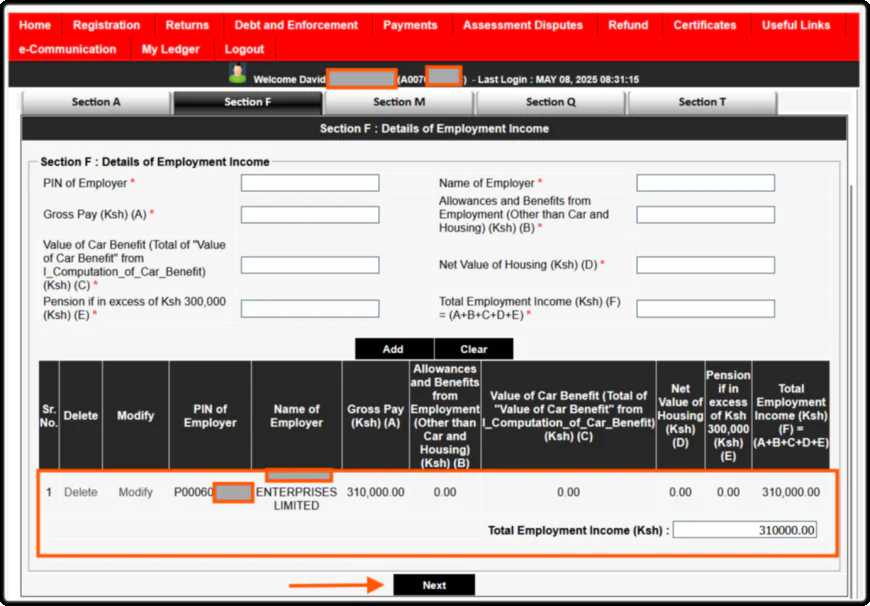

6. Sections F and M : Return Information Section

In this section, verify that the pre-populated gross pay matches your P9 form details before proceeding.

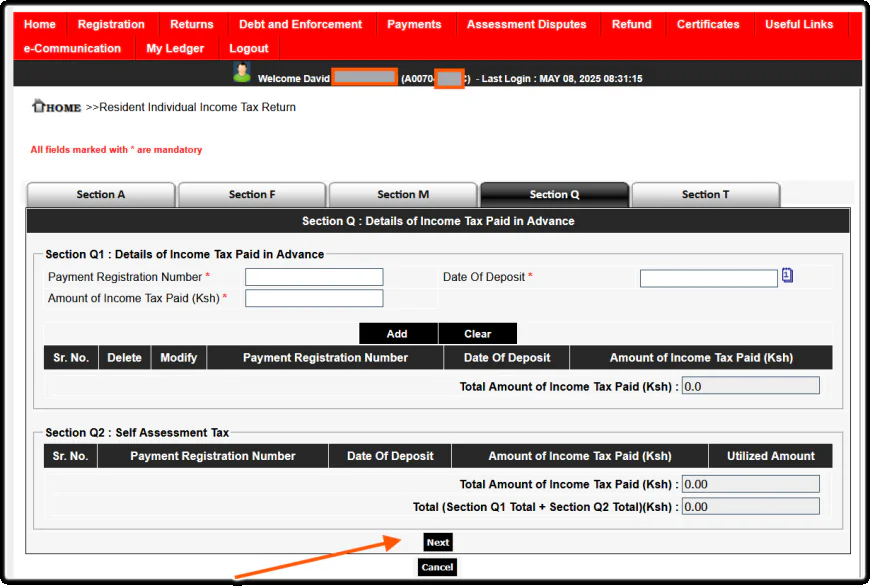

7. Section Q : Return Information Section

Record any advance income tax payments made during the year by entering payment registration number(s), amount(s), and deposit date(s) if applicable.

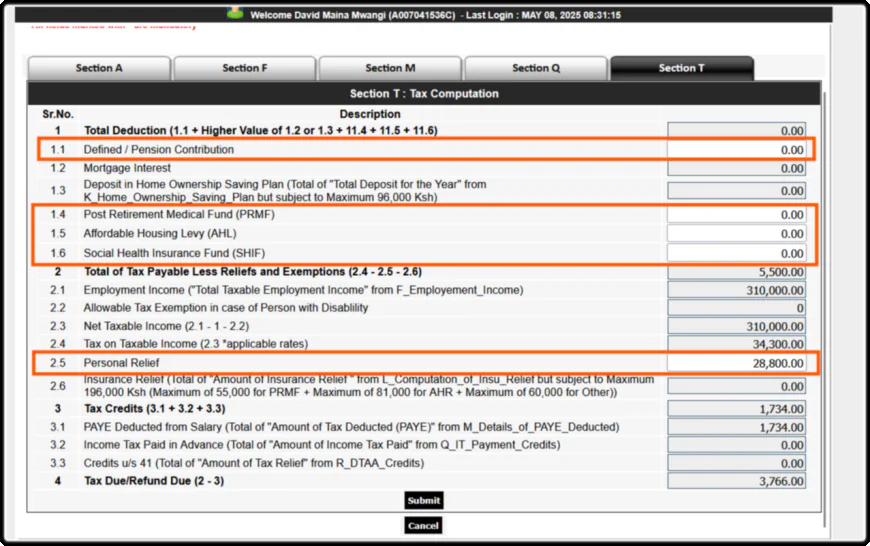

8. In Section T: Return Information Section

Fill highlighted areas to claim contributions for Defined Pension Contribution, Post-Retirement Medical Fund (PRMF), Affordable Housing Levy (AHL), Social Health Insurance Fund (SHIF), along with Personal Relief calculated at KES 2,400 monthly totaling KES 28,800 annually.

Ensure that you check and verify all the information from your employer's P9 Form before submitting the return. Once submitted, download and print the acknowledgment receipt.

9. Documents Needed Before Filing Your Employment Income Return

Before filing your tax returns with employment income only form, you will need the following documents:

- A P9 form from your employer: This document provides a summary of the tax deductions made by your employer during the 2024 tax period.

- An Insurance Policy Certificate: Required if applicable to your situation.

- A Mortgage Certificate: Necessary if you have a mortgage and it applies to your circumstances.

- A Tax Exemption Certificate: Needed if you qualify for any tax exemptions.

10. Important Considerations for Filing Your Tax Returns

- If you make an error while filing, you have the option to submit an amended return.

- Even if you were employed in 2024 and lost your job, you must still file a return for that year.

- Having multiple employers in 2024 requires you to file a return that includes all income received from each employer.

- If you had no income in 2024, it is necessary to file a NIL return.

- For those with employment and additional income from side jobs (side hustle), it is essential to declare all sources of income alongside your primary job earnings.

- Partners in partnership firms are obligated to file their returns individually.

- Any foreign income earned in 2024 must also be declared on your tax return.

11. Useful Video Guide

12. Useful Link

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0