How to File a NIL Tax Return for Companies for the Year 2024

For companies with no income, filing a NIL tax return is a simple process and ensures compliance with tax regulations, avoiding penalties for non-submission. Follow this step by step guide to navigate the filing process effectively and maintain compliance while preventing potential penalties.

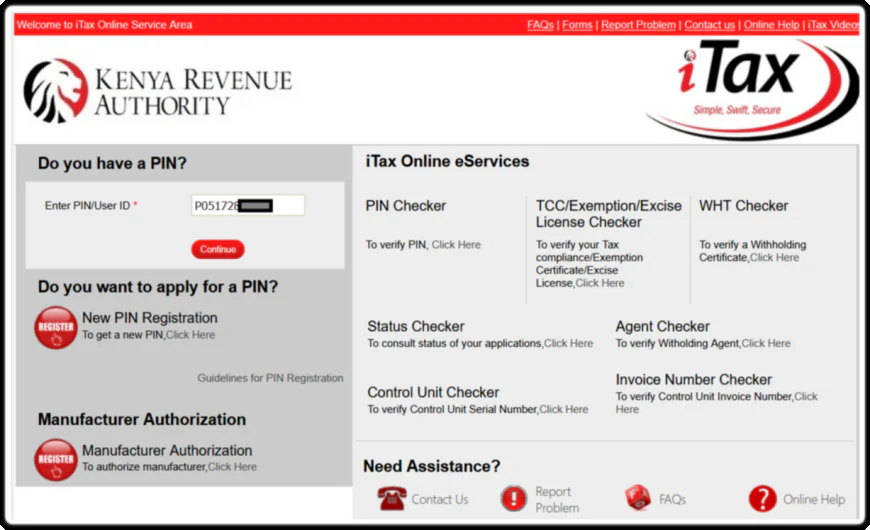

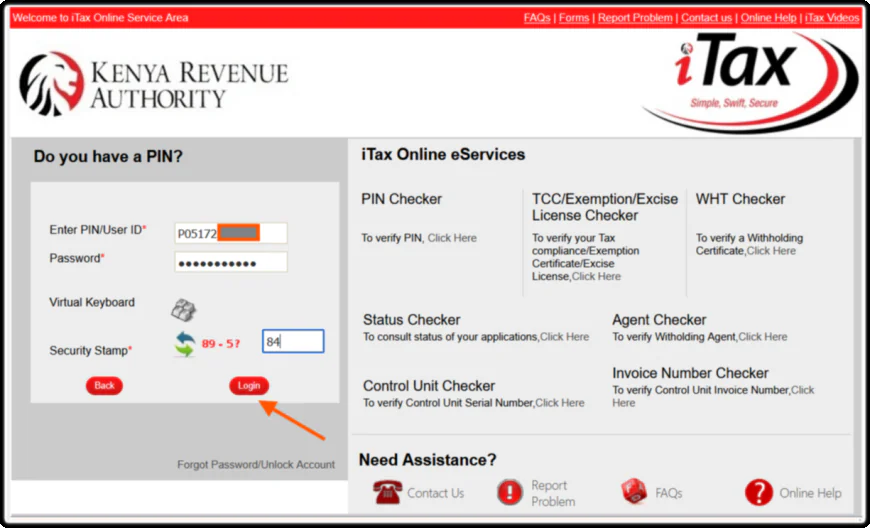

2. The Login Page of the iTax Portal.

Proceed to the login page where you will be prompted to input your password.

3. Navigate to the Returns Tab Menu Section

Once logged in, navigate to the Returns Tab Menu Section.

4. Click File Nil Return

Click on "File Nil Return" from the dropdown menu under the Returns Tab.

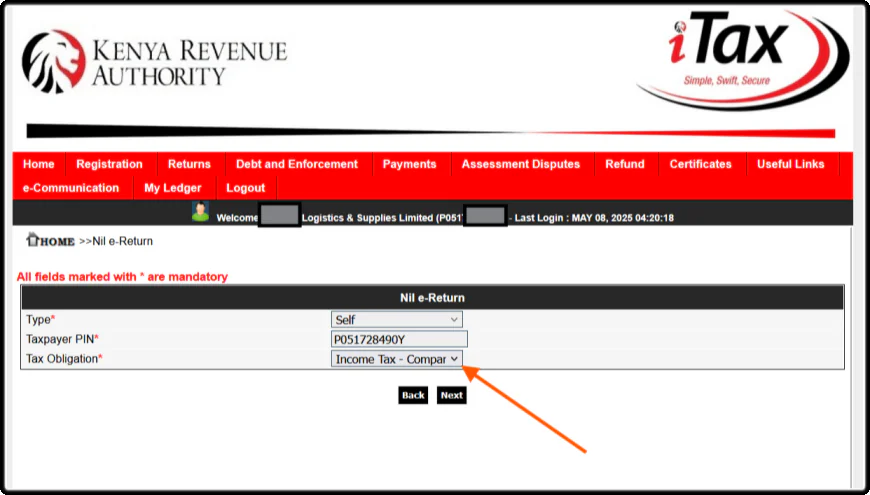

5. Select Your Company's Income Tax Obligation

Select your registered tax obligation from the list provided:

- For Resident/Local Companies: Choose "Income Tax-Company"

- For Partnerships: Choose "Income Tax-Partnership"

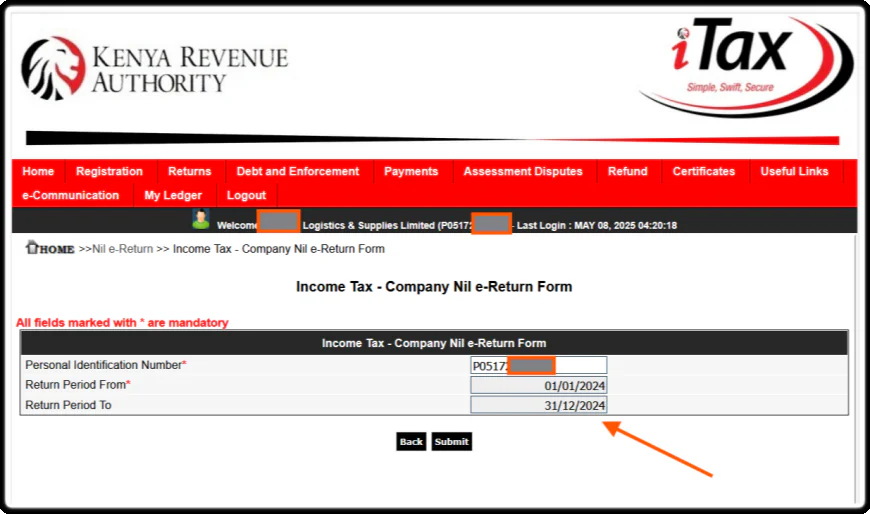

6. Select the Tax Return Period

Determine and select the appropriate Tax Return Period based on your company's accounting period; this information will be automatically populated for verification.

After verifying that all details are correct, click the submit button.

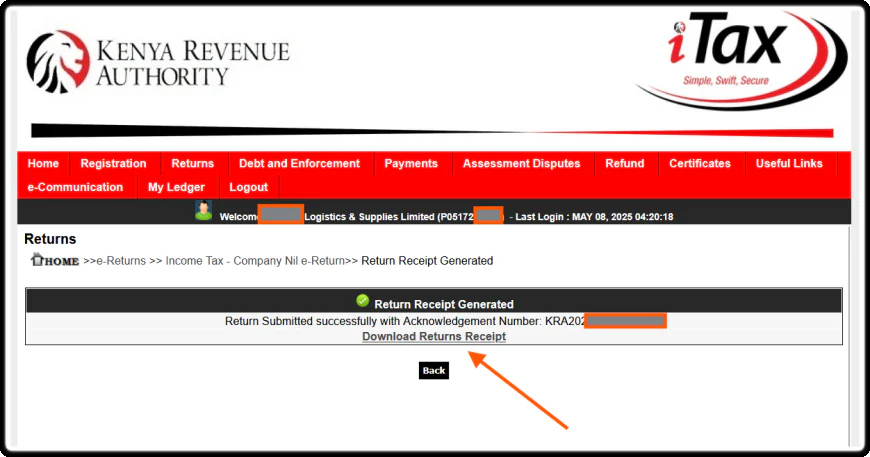

7. Download the Acknowledgement Receipt

Download and save your acknowledgement receipt, which confirms the successful filing of returns and includes all necessary details for reference.

8. Useful Video Guide

9. Useful Link

Was this information helpful ?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0