How to Apply for the Tax Compliance Certificate on iTAX

Want a KRA Tax Compliance Certificate (TCC)? This guide simplifies the process, helping taxpayers navigate their application with ease. Here’s how to apply and download it, follow this step by step procedure and visit iTax to make your application.

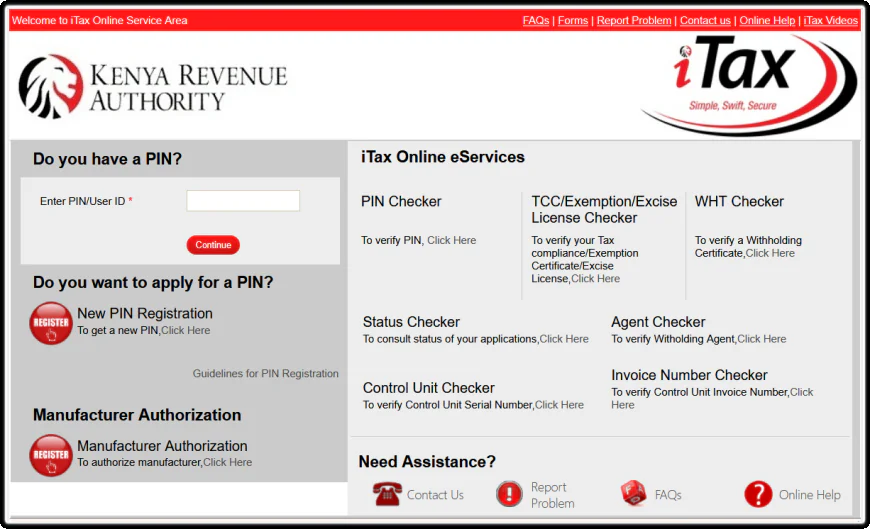

1. Log in into Your iTAX Account

To begin, navigate to the KRA iTax Portal . Once there, log in to your account using your Personal Identification Number (PIN) and password.

If you do not yet have an account, you will need to register for one using your KRA PIN.

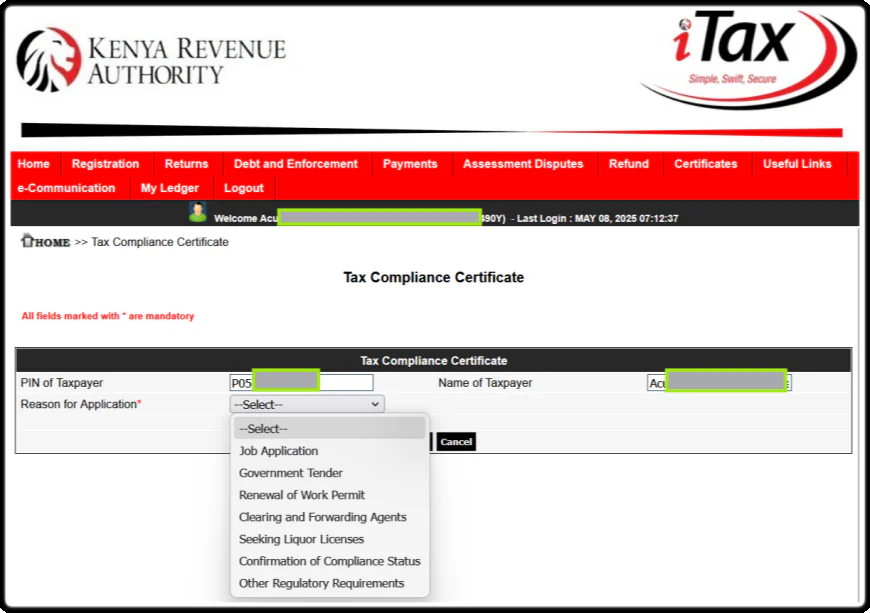

2. Navigating to the Certificates Section

Once logged in, navigate to the 'Certificates' section on the dashboard and select 'Apply for Tax Compliance Certificate (TCC)' from the dropdown menu.

3. Navigating to the Tax Compliance Section

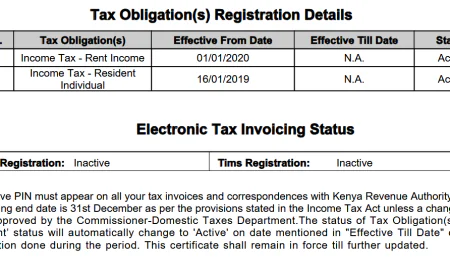

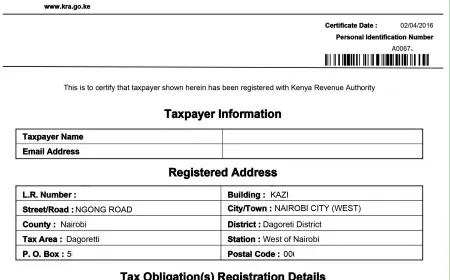

After selecting this option, you will be prompted to fill out an application form with details such as your PIN and specific tax obligations.

4. Filling Out the Required Information for Your Request

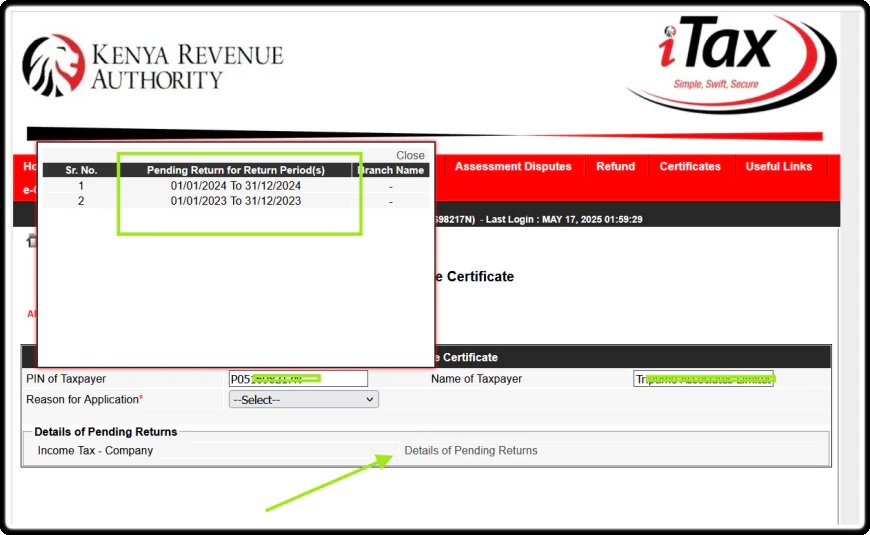

5. Submitting Your Request and Awaiting Approval

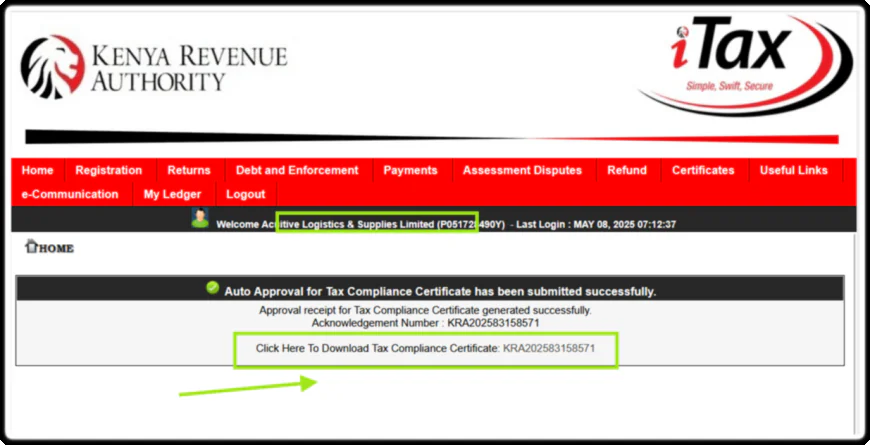

Once you submit your request, the system will approve your TCC if all compliance requirements are met.

If there are outstanding tax issues like pending returns or unpaid taxes, the system will notify you to resolve them before issuing the TCC.

6. Download and Print the Tax Compliance Certificate

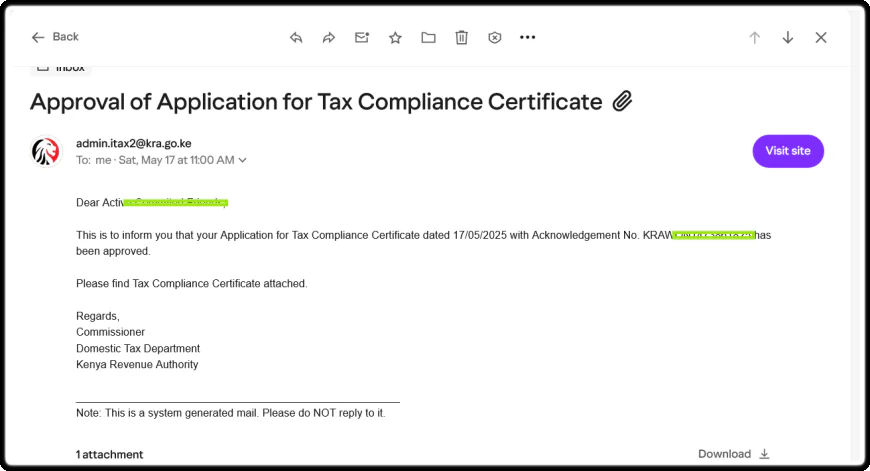

Once approved, you can download the TCC from the iTax portal. You will also receive a notification via email when the TCC is ready.

7. Video Tutorial

Watch a step by step tutorial on how to apply for the TCC and visit iTax to make the application:

8. Useful Link

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0