Non-Resident Income Tax

Non-resident income tax is an important aspect of taxation in Kenya. It applies to individuals and businesses that earn income from sources within the country but are not considered residents for tax purposes. In this article, we will provide a comprehensive overview of non-resident income tax in Kenya, including its definition, who is liable to pay, and how it is calculated.

1. Understanding Non-Resident Income Tax

Non-resident income tax is an important aspect of taxation in Kenya that applies to individuals or entities who earn income within the country but are not considered residents for tax purposes.

2. Who is Considered a Non-Resident for Tax Purposes in Kenya?

In Kenya, non-residents are individuals who do not have a permanent establishment in the country and spend less than 183 days within a tax year. Non-residents are subject to taxation on their Kenyan derived source of income, which includes income from either employment, business activities, and investments.

3. Taxation Rates of Non-Resident Individuals and Companies in Kenya

The tax rates for non-residents vary depending on the nature of their income. For employment income, a flat rate of 30% is applied. Business profits earned by non-residents are taxed at a rate of 37.5%. Additionally, rental income derived from Kenyan property is subject to withholding tax at a rate of 30%.

4. Exemptions and Deductions Available for Non-Residents in Kenya

One of the key exemptions available for non-residents is the exemption on foreign-sourced income. This means that income earned outside of Kenya by non-residents is generally not subject to taxation in Kenya. However, it's important to note that this exemption may vary depending on specific circumstances and any applicable double taxation agreements between Kenya and the individual's country of residence.

In addition to exemptions, there are also certain deductions that non-residents can claim when calculating their taxable income in Kenya. These deductions include expenses directly related to earning income in Kenya, such as business expenses or professional fees incurred while conducting business activities within the country.

It's worth mentioning that non-resident individuals may still be subject to certain taxes in Kenya, such as withholding taxes on specific types of income or capital gains tax on certain transactions. Understanding these obligations and seeking professional advice can help ensure compliance with Kenyan tax laws while taking advantage of available exemptions and deductions.

It is also important to understand that non-resident are not entitled to any personal relief granted in Kenya.

5. Filing Requirements and Procedures for Non-Resident Taxes in Kenya

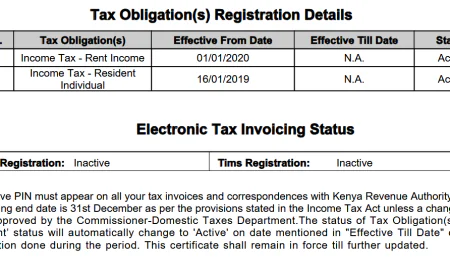

Non-resident individuals or entities who earn income in Kenya are subject to certain tax obligations. These obligations include reporting their income, calculating their tax liability, and submitting the necessary returns, forms and documentation to the Kenyan Revenue Authority (KRA).

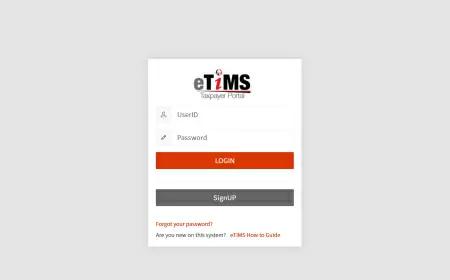

One of the key requirements for non-residents is obtaining a Personal Identification Number (PIN) from the KRA. This PIN serves as a unique identifier for tax purposes and is required when filing taxes in Kenya. Non-residents can apply for a PIN by completing an online application form on the KRA iTax Platform and providing supporting documents such as a copy of their passport or alien identification card.

Once a non-resident has obtained a PIN, they are required to file an annual tax return if they have earned taxable income in Kenya during that year. The tax return should be filed using the appropriate form provided by the KRA.

It's important for non-residents to accurately report their income from all sources within Kenya, including employment income, rental income, business profits, dividends, and capital gains. They may also be eligible for certain deductions or exemptions based on double taxation agreements between Kenya and their home country.

Non-residents should carefully review any applicable tax treaties between their home country and Kenya to determine if they qualify for any relief or benefits. These treaties often provide provisions to avoid double taxation on income earned across borders.

In terms of procedures, non-resident taxpayers are typically required to submit their annual tax returns by June 30th of each year following the end of the tax year. The returns are submitted electronically through the KRA's online iTax platform or physically seeking assistance at any designated KRA offices.

Failure to comply with these filing requirements and procedures may result in penalties and interest charges. It is therefore essential for non-residents to familiarize themselves with the tax laws and seek professional advice if needed to ensure accurate and timely filing of their taxes in Kenya.

Was this information helpful ?

Like

2

Like

2

Dislike

0

Dislike

0

Love

1

Love

1

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

2

Wow

2