Expanding Your Business Into Kenya

Expanding your business into new markets can be an exciting opportunity for growth and success. One market that has been gaining attention in recent years is Kenya. With its growing economy and increasing consumer demand, Kenya presents a promising landscape for businesses looking to expand their operations. This guide aims to provide you with valuable insights and practical tips on how to successfully expand your business into Kenya.

3. Navigating Regulatory and Legal Considerations for Doing Business in Kenya

When it comes to doing business in Kenya, it is crucial to have a clear understanding of the regulatory and legal landscape that governs commercial activities. Navigating through these considerations is essential to ensure compliance and mitigate potential risks.

In Kenya, there are several laws and regulations that businesses need to be aware of, ranging from;

1. Company Registration : The Companies Act provides guidelines for the incorporation and operation of companies.

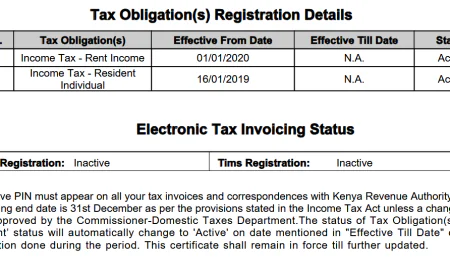

2. Tax Obligations : The Income Tax Act outlines the taxation framework. Taxation in Kenya is based on Article 209 of the Constitution, which grants the National Government the authority to levy various taxes such as Income Tax, Value Added Tax, Excise Duty, Customs Duties, and other duties on imports and exports. In addition to any other taxes that may be established by an Act of Parliament or County Assembly.

The Kenya Revenue Authority is the centralized organization responsible for assessing, collecting revenue, administer and enforce laws related to revenue.

3. Industry Specific Regulations : Businesses must also be familiar with industry specific regulations that may apply to their sector. For example, if you are operating in the financial services industry, you will need to comply with regulations set by the Central Bank of Kenya,Capital Markets Authority, Insurance Regulatory Authority, Sacco Societies Regulatory Authority (SASRA) and Nairobi Securities Exchange.

4. Employment Law : Employers must adhere to labor laws and regulations when hiring employees, including matters such as minimum wage requirements, working hours, and employee rights.

To navigate these regulatory and legal considerations effectively, it is advisable for businesses to seek professional guidance from local experts or legal advisors who have a deep understanding of the Kenyan business environment.

They can provide valuable insights into compliance requirements and help businesses develop strategies for mitigating risks associated with legal non-compliance.

By having a comprehensive knowledge of the regulatory framework in Kenya and staying updated on any changes or updates in legislation, businesses can ensure smooth operations while minimizing any potential legal liabilities or penalties that may arise from non-compliance.

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0