Capital Gain Tax

This guide provides an overview of capital gain tax (CGT) in Kenya. CGT is a tax on profits from selling capital assets like property and shares. The guide covers the definition, calculation, exemptions, and filing requirements for CGT in Kenya. Readers will learn how CGT works and be able to make informed decisions when buying or selling capital assets.

1. What is Capital Gain Tax and How Does it Apply in Kenya?

This is a tax chargeable on the whole of a profits or gains which accrues to a company or an individual (resident or non-resident) upon selling or transfer of a property (land, buildings and marketable securities) based on the amount by which the asset appreciated.

In Kenya, this tax is applicable to both individuals and companies who make profits from the sale of assets such as real estate and securities (shares).

Capital Gain Tax in Kenya is a final tax and cannot be offset against other income taxes.

2. When is Capital Gain Tax Applicable in Kenya?

In Kenya, Capital Gain Tax (CGT) is applicable in various situations, such as the sale of land, buildings, and securities (shares).

For instance, if an individual sells their primary residence or personal vehicle, they are exempted from paying CGT. However, if they sell a rental property or an investment property, they will be required to pay CGT on the profit earned.

3. Capital Gain Tax Rates

Effective 1st January 2023, the CGT initial rate was increased from 5% of the net gain to 15% of the net gain.

CGT rates in Kenya vary depending on the type of asset sold and the duration it was held before being sold. For example, for immovable property held for less than three years before being sold, CGT rate is 30% while for movable property held for more than one year but less than three years before being sold attracts 15% CGT rate.

4. Capital Gain Tax Calculator Kenya

5. Exemptions from Capital Gains Tax in Kenya

The list of some of the exemptions and exclusions listed below are accessible through Kenya Revenue Authority website (www.kra.go.ke).

- Income that is taxed elsewhere as in the case of property dealers.

- Issuance by a company of its own shares and debentures.

- Transfer of property for the purpose only of securing a debt or a loan.

- Transfer by a creditor for the purpose only of returning property used as security for a debt or a loan.

- Transfer by a personal representative of any property to a person as beneficiary in the course of the administration of the estate of a deceased person.

- Transfer of assets between spouses.

- Transfer of assets between former spouses as part of a divorce settlement or a bona fide separation agreement.

- Transfer of assets to immediate family.

- To a company where spouses or a spouse and immediate family hold 100% shareholding.

- A private residence if the individual owner has occupied the residence continuously for the three-year period immediately prior to the transfer concerned.

6. Capital Gains Tax Levied on Non-Resident

Capital gain tax is taxable to a non-resident if the gain is derived from sale of property situated in Kenya. In circumstances whereby there is double Tax Agreements, then the non-resident can be exempted from paying the capital tax gain.

7. Capital Gain Tax Payment

Capital gain tax payment is due on or before initiation process of the transfer of property is done but not later than the 20th day after the transfer is completed.

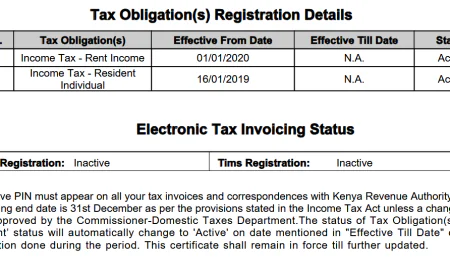

Payment is done online on the Kenya Revenue Authority (KRA) iTax Portal. After initiating the payment, a payment slip is generated that is paid at any Kenya Revenue Authority (KRA) appointed banks or mobile money payment channels.

A person is required to make the payment within 30 days before the payment slip expires.

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

1

Sad

1

Wow

0

Wow

0